The passing of the Property Tax of Bhutan 2022, in the current National Assembly (NA) session will benefit the state in terms of revenue generated through taxes.

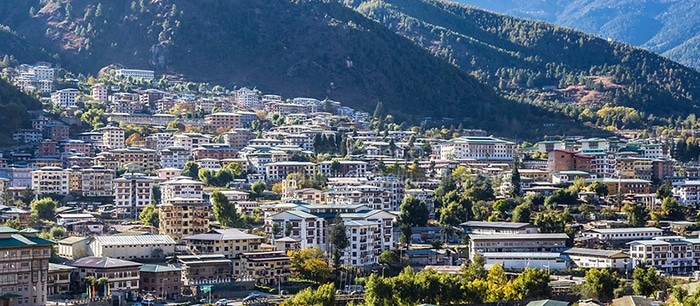

Of all, the benefits will be felt by the four Thromdes, which will then translate into the delivery of quality services to the people. Taking into consideration only the urban property tax, rough calculations show that Thimphu Thromde’s urban core sections alone will generate an average annual income of Nu 54.9 mn. Other Thromdes will also see a rise in income through taxes.

During the introduction of the Property Tax Bill 2022 to the NA, the Ministry of Finance, (MoF) Lyonpo Namgay Tshering said the four Thromdes will be benefiting greatly and will be able to provide better facilities to the public.

“With the current property tax, the Thromdes cannot generate much revenue from taxes collected but must rely only on taxes to cover their expenses,” Lyonpo said.

Further, as per the Thromde rules, 2011, the general functions of the Thromdes are raising revenue, borrow, spend and invest money to enable the Thromde to perform its functions.

According to records of Thimphu Thromde, there are almost 223 acres of land in the urban core (UC) area of the Thromde with 500 numbers of plots registered within the core area. There are eight sub-precincts in the urban core area: sub-precinct 1A, sub-precinct 1, sub-precinct 2, sub-precinct 2A, sub-precinct 2B, sub-precinct 3, sub-precinct 4, and sub precinct 4A.

The revised property tax for sub-precinct 2 B, sub-precinct 3, sub-precinct 4, and 4 A is Nu 0.23mn per acre, while sub-precinct 1 A is Nu 0.26mn, sub-precinct 1 is Nu 0.27mn, sub-precinct 2 is Nu 0.24 and sub-precinct 2 A is Nu 0.24mn, under the urban core area in Thimphu.

Prior to the revision, the property tax rate for all of the aforementioned precincts was the same at Nu 21,780 per acre.

A rough calculations show that revenue generated as property tax was Nu 4.8mn. While the total area in different precincts could not be obtained, with the revision, and calculating the increase in the taxes based on the average values, the difference is almost close to Nu 50mn.

In Samdrup Jongkhar, property owners will need to pay Nu 45,515.75 per acre as tax annually for Urban Core (UC) 1 and Nu 15,309.15 per acre for UC 2. The Thromde’s initial tax was Nu 21, 780 per acre. With the Thromde comprising 23.5 acres of land in UC 2 and nine acres in UC 1, the Thromde will now be able to generate a total of Nu 0.76 mn just from the urban core areas.

Similarly, there are three urban villages (UV) under Gelephu Thromde: UV 1, UV 2, and UV 3, as well as UC 1 under the urban center. As per Gelephu Thromde’s report, 8.195 acres fall in UV 1, 12.761 acre in UV 2, 469.56 In UV 3 and 17.07 acre in UC 1.

This means, given the revised property tax, Gelephu Thromde will be able to generate roughly Nu 13.4 mn from the urban villages and urban core areas alone.

While the paper couldn’t contact the Phuntsholing Thromde, the Samdrup Jongkhar Thrompon, Thinley Namgyal said that they were not able to collect much taxes under the 1992 taxation regime.

“Samdrup Jongkhar thromde, unlike other Thromdes, doesn’t have many income producing sources other than tax, which is quite low. While we are still trying and giving required amenities to the public, we are running into losses, much couldn’t be done owing to budget restraint,” he said, adding that the revision would help them.

Gelephu Thrompon Tshering Norbu said that all the Thromdes cannot be categorized as the same because certain thromdes, such as Thimphu and Phuntsholing, are self-sufficient, whilst others, such as Gelephu and Samdrup Jongkhar, are not at a comparable state of self-sufficiency.

“With the new proposed tax, we will be able to provide better service in the form of infrastructure, better street lights, and recreational centers,” he said, adding that ultimately the public will benefit.

“This is because we have to rely heavily on taxes due to the limited number of income-generating sources,” the Thrompon said.

Meanwhile, each Thromde’s percentage increase in taxes from urban areas is different, Thimphu and Phuntsholing Thromdes have the highest percentage increases, ranging from over 200% to 1199%.

Thus, property owners in the two Thromdes will be paying more than people in the other two Thromdes, which automatically leads to huge increase of revenue in Thimphu and Phuentsholing Thromdes.

Those following the discussions in the Parliament on this issue say that though people may need to pay more taxes, it is justifiable in Thimphu and Phuentsholing Thromdes as the taxes paid was negligent.

“I am not a legislature. But, I think that the Property Tax had to be revised as taxes were still based on the policy of 1992. If the governments just leave it unattended, a time will come where the need to increase the taxes will come and at that juncture, people may land up paying a lot more,” a private entrepreneur in Thimphu said, citing the Tourism industry’s sustainable development fee (SDF) as an example.

“As nothing was done for long, we had to take a huge jump. This would not have happened if our legislatures had the foresight,” he said.

The National Assembly endorsed the government’s proposal of fixing property taxes at a uniform rate of 0.1% on taxable value. However, taxes collected will be centralized and then distributed to the different Thromdes and Local Governments (LGs).

Tshering Pelden from Thimphu