However, prices of vehicles imported from third countries have gone up

Vehicles imported from India come cheaper after the Goods and Services Tax (GST) imposition.

However, prices of vehicles imported from third countries have increased due to the valuation of tax from point of entry (PoE) to point of sale (PoS).

An official from Zimdra Automobiles said the cars they deal with now are cheaper by Nu 10,000-70,000 while Bhutan Hyundai Motors’ spokesperson said that the price decrease depends upon the car model and variant.

“For our bigger cars, the drop has been greater and for the smaller cars the decrease is less,” she said adding that in order to neutralize GST effect, the government has changed Business Sales Tax (BST) collection from PoE to point of PoS, which has brought prices to almost the same level that existed prior to GST. “Though GST has not affected the prices of vehicles imported from third countries, the government’s recent circular to collect BST at the PoS will affect the car prices but difference in price will depend upon the model.”

Meanwhile, State Trading Corporation Bhutan Limited (STCBL) reported 10%-20% increase in vehicle prices.

Tax calculation

Pre-GST, the sales tax was levied at the PoE on the cost of vehicle of the company including the excise duty paid in India. The green tax is levied only on the cost of vehicle. The rate of sales tax and green tax varies depending upon the CC engine of the vehicle. Therefore, before GST, the price for the vehicle buyer essentially includes the cost of the vehicle from the company, excise duty, sales tax and the green tax paid at the PoE and the profit margin of the business.

Post-GST, vehicles from India will be imported without excise duty and IGST. This is because, excise duty has been subsumed with the introduction of GST in India and all exports to foreign countries including Bhutan is zero-rated.

Since vehicle prices are expected to fall post-GST, the Ministry of Finance on August 10 notified that sales tax on vehicle will be collected at the PoS from August 11.

As per the rules released by the finance ministry, Sales Tax on vehicles at the PoS shall be valued, levied and collected on the sales price. Sales price means the price or value of vehicles shown on the invoice which shall include all elements of cost such as value of import, freight, insurance, other expenses and the profit margin of the business. Customs duty and green tax shall not form part of the sales price. Therefore, the price of the buyer essentially includes the price or value of vehicles shown on the invoice issued by vehicle dealer, sales tax calculated on the invoice price and green tax and customs duty paid at the PoE.

An official from the revenue and customs department said that even after shifting the sales tax on vehicles to the PoS post-GST, quick estimates shows that prices of vehicles imported from India have decreased generally. For instance, the price of Maruti Alto car has decreased by around 2.3% compared to the pre-GST price. Hyundai Creta cars prices have decreased by around 7% on an average.

The officiating secretary of the Ministry of Economic Affairs, Sonam P Wangdi, said that for vehicles not exceeding 1,500cc there is an average fall in import value by 13.6% and for vehicles above 1,500cc there is an average fall in import value by 21%.

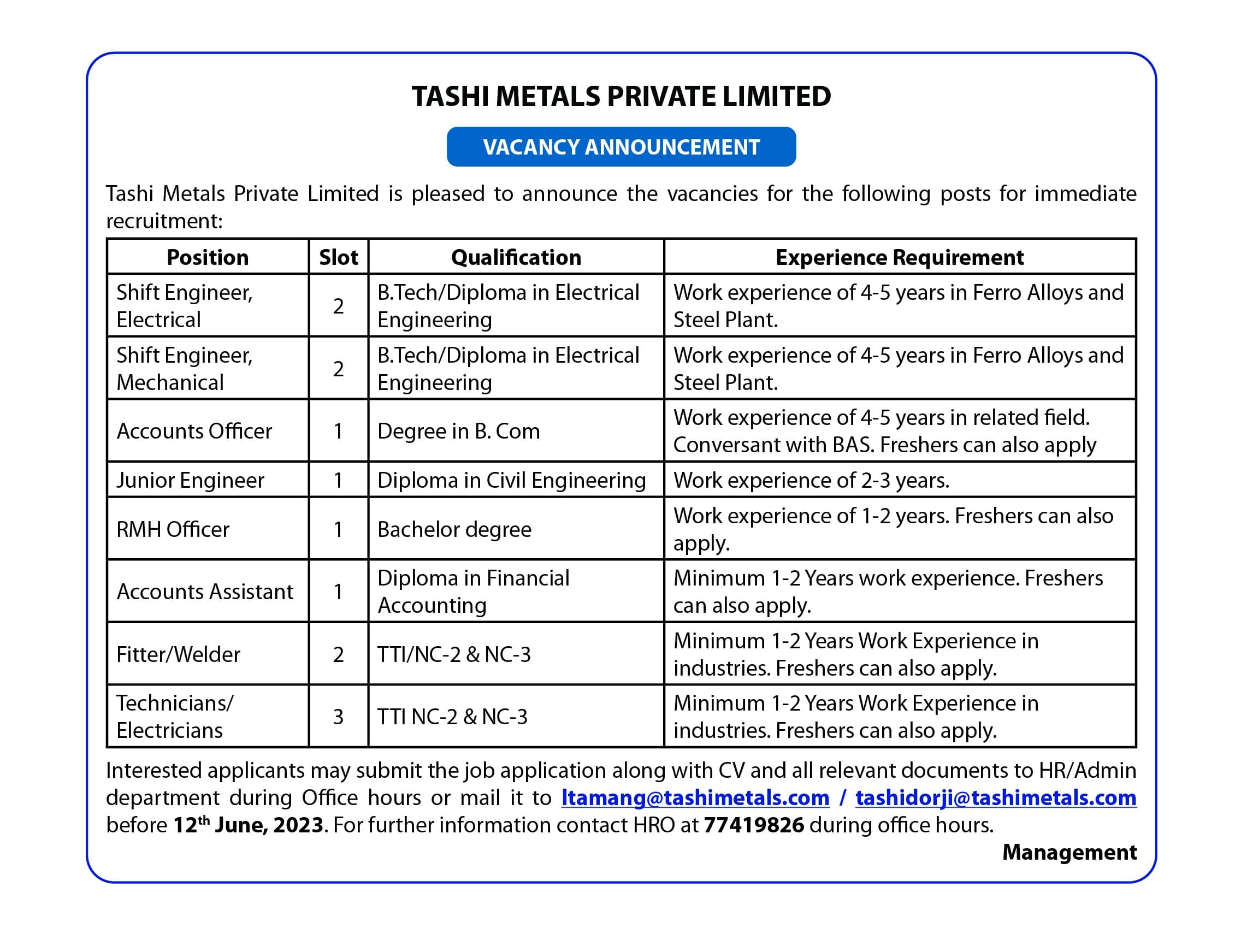

Prices of vehicles imported from India decreased

| Model | Old price | New price | Price difference |

| Maruti Alto 800 standard | 408,000 | 397,776 | -10,224 |

| Martuti Celero LXI | 602,000 | 586,786 | -15,214 |

| Grand i10 sportz | 788,300 | 767,950 | -20,350 |

| EON sportz | 5,81800 | 565,590 | -15,850 |

| Elite i20 | 937200 | 905,685 | -31,515 |

| Active i20 | 10,20100 | 999,140 | -20,960 |

| Cretia 1.6 patrol | 1,339300 | 1,239,600 | -99,700 |

| Muruti Baleno sigma petrol | 808,315 | 785,487 | -22,828 |

| LC Prado (VX-00)/AT/Turboo | 6,248,679.75

| 6,690,767 | +442,088.75

|

| Landcruiser Family LC200 (VX-01)/AT | 14,295,679.75 | 15,323,561.16 | +1532,351.16 |

| Coaster Bus 6 cyclinder 00/4.2cc | 5,873,031 | 6,181,157 | +308,126

|

| Maruti Vitara Brezza LDI | 1,113,130 | 1,063,596 | -47,734 |

| RAV4 full option | 4,356,140 | 4,664,623 | +308,483 |

| HiAce High Roof 02 | 3,273,000 | 3,469,538 | +196,538 |

| Fortuner (2.8/(4X4) | 5,464,640 | 4,538,801 | -925,839 |

| Etios SD/VD | 1,325,013 | 1,005,456 | -319,557 |

Dechen Dolkar from Thimphu