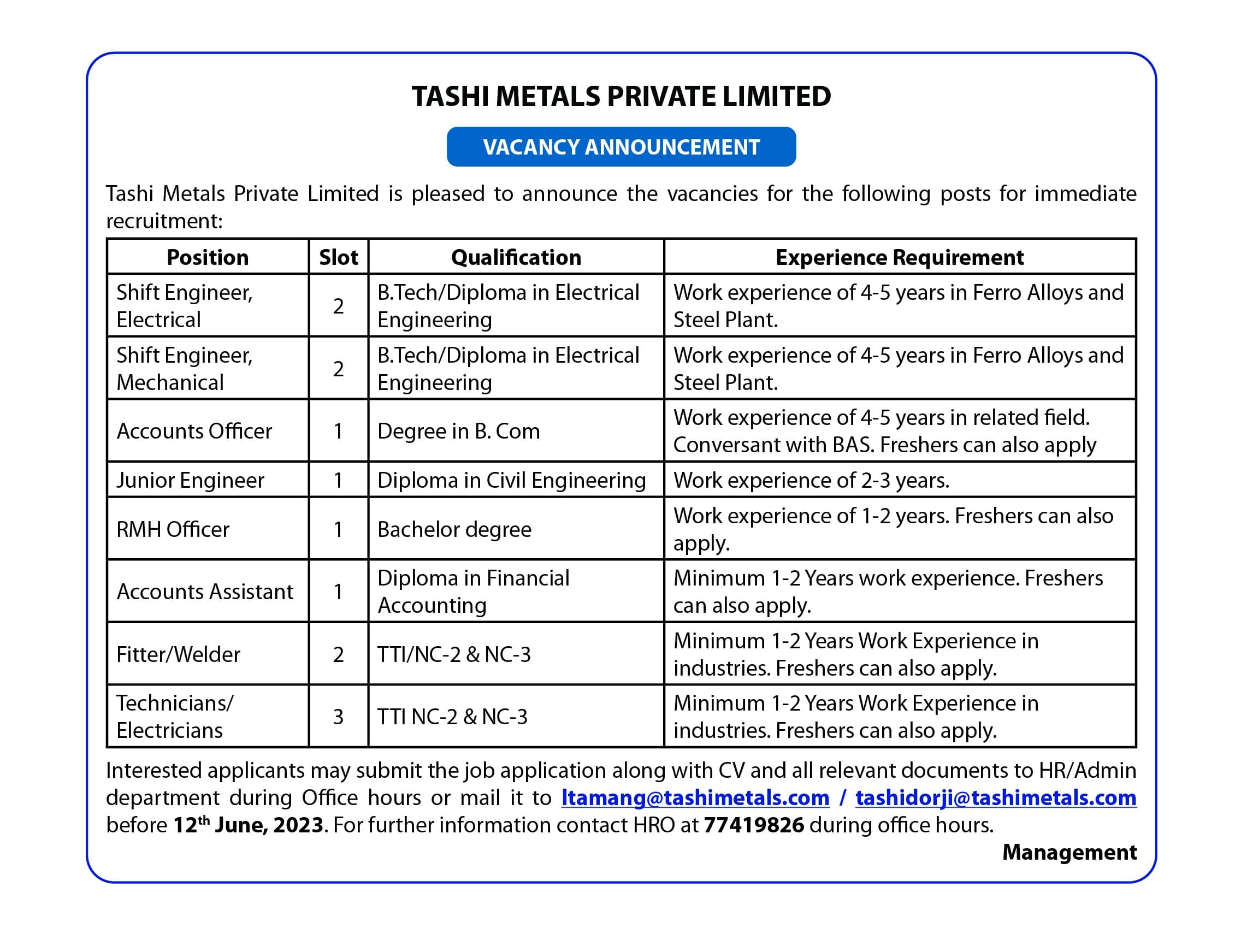

Parents who are aged between 20 to 50 years and children who are aged between 0 to 10 years can opt for this scheme

Of the many insurance policies of the Royal Insurance Corporation of Bhutan Limited (RICBL), the most sought after scheme today has become the Millennium Education Scheme.

There are a total of 57,834 policies under this scheme as of May 31, 2021.

According to the RICBL officials, there are more clients in this scheme because it provides good future provisions for a child’s education. So more clients go for this scheme.

“Other factors such as higher bonus rate and less premium amount also play an important role in clients,” an official said.

According to the RICBL, the Millennium Education Scheme is the best and the safest investment that anybody can think of.

“The scheme has a highly competitive interest rate, the risk of both parent and child is covered, tax benefit, and the future of your child is secured. Through this scheme you will have security and peace of mind,” officials said.

The scheme is mainly a life insurance policy which provides a saving component for a child’s future education expenses along with insurance protection to both the parent (either father/mother) and the child.

Parents who are aged between 20 to 50 years and children who are aged between 0 to 10 years can opt for this scheme.

A RICBL official said that the scheme is for a total period of 23 years. However, the premium has to be paid for a total of 18 years, which means the in-between duration of five years will be a free insurance cover period where no premiums need to be paid.

The policy duration depends on the child’s entry age during the commencement of the policy. The modality of this scheme is that the proposer can be either a father or mother or a legal guardian.

After the premium paying period is over, an individual will get 20% of the sum assured for the next five years. On maturity, bonus at 6% on the sum assured for the total premium paid duration will be given.

During an uncertain event, say death of the proposer, 20% of the sum assured will be given to the nominee and future premiums will be waived off. However, the policy will continue on the child’s name.

In the event of the child’s demise, a refund of the premium or sum assured will be given to the proposer as per the risk coverage conditions.

The official said that the advantage of this scheme is that it provides provision for saving as well as insurance protection to both the child and the parent if any uncertain event happens during the policy period.

The official said that this scheme is one of the best life insurance policies.

“Saving in a bank provides only saving options with certain interest during maturity. However, through this scheme a client can avail both saving and insurance protection options, the official said.

For instance, according to the official, if one insures their child at the age of one, they may pay a premium of Nu 509 per month (Nu 6,104 per year), which is just Nu 16 per day till 1-18 years. But from the 18th year onwards, the child gets Nu 20,000 annually for five years (Nu 100,000). And on the 23rd year, the child receives Nu 102,000 as bonus (Nu 6,000x 17 years=Nu 102,000). The total benefits, therefore, is that the child gets Nu 202,000 for paying Nu 103,768 plus a tax waiver worth Nu 51,884 for 17 years.

The maximum sum assured that an individual can opt for under this scheme is Nu 30,000 to Nu 1,000,000 per child.

Dechen Dolkar from Thimphu