Bhutan’s fiscal outlook for FY 2025–26 shows signs of cautious optimism, with the government revising its domestic revenue projections upward while maintaining a measured stance on expenditure and debt management. According to the latest macroeconomic report released by the Ministry of Finance (MoF), domestic revenue is now projected at Nu 74.5 billion (B), an increase of Nu 1.3B over earlier estimates, reflecting stronger non-tax inflows and improved export performance.

The upward revision is primarily driven by a significantly higher-than-expected profit transfer from the Royal Monetary Authority (RMA). While initial projections estimated a transfer of Nu 2.2B, the final figure rose sharply to Nu 3.5B, providing a substantial boost to government revenues. This improvement stems largely from the finalization of export tariffs and enhanced export shares associated with the Punatsangchhu Hydropower Authority Phase II (PHPA-II) project, one of the country’s largest hydropower investments.

The MoF noted that these developments are expected to have a positive spillover effect on revenue projections for the medium term, particularly for FY 2026–27 and FY 2027–28. However, despite the improved outlook, medium-term revenue assumptions remain conservative, reflecting the government’s cautious approach amid ongoing tax reforms and global economic uncertainties.

In addition to domestic revenue, grants continue to play a critical role in Bhutan’s fiscal framework. Total grant inflows for FY 2025–26 are projected at approximately Nu 29.17B, of which Nu 28.21B is expected from external sources and Nu 955.5 million (M) from internal grants. A notable contributor to this increase is the inclusion of a USD 20M (Nu 1.82B Catastrophe Deferred Drawdown Option (Cat DDO) grant from India, extended in response to recent episodes of heavy rainfall and climate-related risks.

India remains Bhutan’s largest development partner, accounting for 69.18% of total grant inflows. Looking ahead, grant receipts are projected to increase by 45% in FY 2025–26 and by 15% in FY 2026–27, supported by higher disbursements from India and other multilateral and bilateral partners. Over the course of the 13th FYP, grants are expected to constitute an average of 23.4% of total government resources, underscoring Bhutan’s continued reliance on external assistance to finance development priorities.

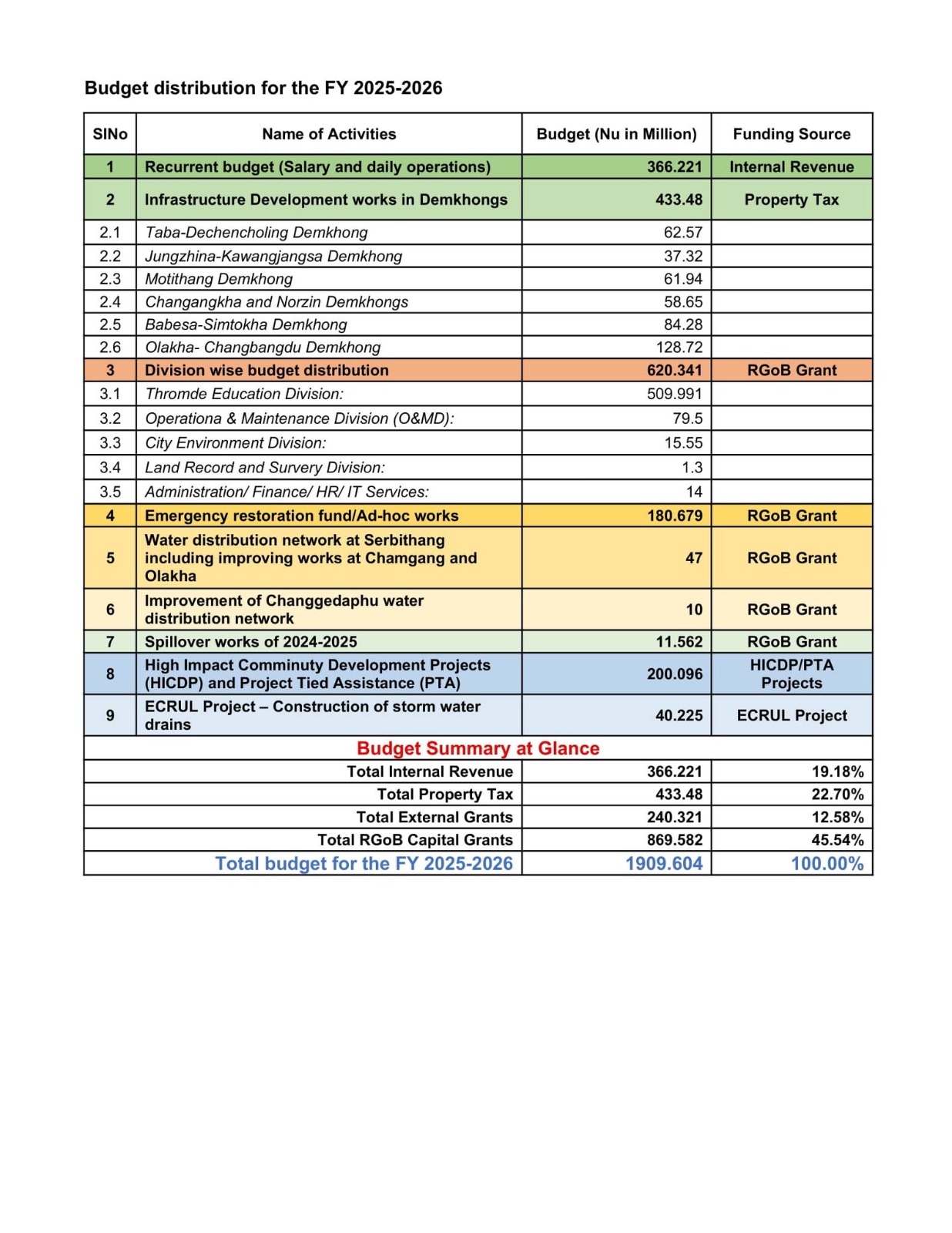

On the expenditure front, the government’s total outlay for FY 2025–26 is projected at Nu 120.21B, marginally higher than previous estimates. The increase is largely attributed to the anticipated rollout of donor-funded projects rather than expansionary fiscal policy. Current expenditures—covering salaries, operations, and service delivery—are projected to grow steadily but remain contained, reflecting the government’s commitment to fiscal discipline.

Capital expenditure, however, is expected to peak in FY 2025–26 and FY 2026–27, before moderating in FY 2027–28. This trend reflects the timing of major infrastructure and energy-related investments. Despite these projections, budget execution remains a concern. As of the first quarter of FY 2025–26, both current and capital expenditure utilization rates are lower than those recorded in the same period last year, pointing to persistent implementation bottlenecks and underexecution of capital projects.

Public debt is projected to rise to Nu 380.54B in FY 2025–26, equivalent to 109.18% of GDP, marking an increase of 1.20 percentage points from previous estimates. The rise is mainly attributed to higher domestic financing requirements and continued external borrowing for large-scale energy projects, including the Bunakha Green Power Project and ongoing solar farm expansions.

External debt accounts for over 92% of total public debt, highlighting Bhutan’s dependence on foreign financing, particularly for hydropower and renewable energy investments. Central government debt is estimated at Nu 127.77B, or 36.66% of GDP, which remains below the 55% ceiling prescribed under Bhutan’s fiscal rules. Nevertheless, the overall debt burden is expected to remain elevated in the medium term as major projects move through their construction phases.

Despite the rising debt levels, the government maintains that Bhutan’s fiscal position remains manageable. Hydropower-related debt is largely considered self-liquidating, given that loans are backed by long-term power export revenues, primarily to India. However, the report cautions that delays in project completion or cost overruns could increase debt-servicing pressures, posing potential risks to fiscal sustainability.

Overall, Bhutan’s fiscal trajectory for FY 2025–26 reflects a delicate balance between leveraging growth-enhancing investments and maintaining macroeconomic stability. While improved revenue performance and strong donor support provide short-term relief, sustained fiscal prudence, timely project execution, and continued diversification of revenue sources will be critical to managing debt risks and ensuring long-term economic resilience.

Sherab Dorji

From Thimphu