People say discussions on this Bill will show if Bhutan’s elected parliamentarians swing towards the national or personal interests

One of Bills to be tabled in the forthcoming winter session of the Parliament is the Property Tax Bill 2022, which the finance minister Namgay Tshering has passionately taken up. While it was to be deliberated earlier, sources in the ministry of finance (MoF) say it could not be done due to changes in the Property Assessment and Valuation Agency (PAVA) rates. Further, the Bill is not just intended to revise property taxes, but also correct several anomalies of the Revised Taxation Policy 1992, which is followed even today for property taxes.

Observers also say that the government has been very compassionate and that it is time now for the people to pay higher taxes, as the revenue property owners generate is very high. And in the words of some people, this is also a test of the wisdom of Bhutan’s elected parliamentarians.

Business Bhutan also learned that the current Bill has slightly increased the taxes compared to what was to be presented in the summer session of the Parliament 2022. It happened due to changes in PAVA rates.

Currently, the tax revenue generated from land is not even Nu 100 mn. If the proposed Bill gets through the Parliament the government will see an increase of about Nu 250mn in revenue from land tax itself. Additionally, tax revenue from buildings/houses is a mere Nu 6.00 mn. Through the proposed Bill, revenue from houses alone will more than Nu 100 mn.

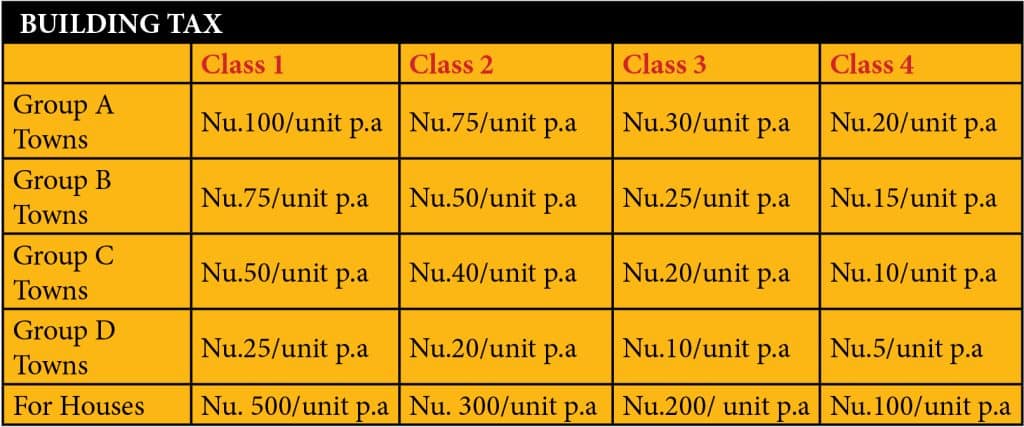

Meanwhile, as per the Revised Taxation Policy 1992, towns in Bhutan have been grouped as Group A, B, C and D. Taxes differ based on the classification. Thimphu, Phuentsholing and Samdrup Jongkhar are graded as Group A and land taxes per sq.ft for the three are just 50 and 25 chetrums for commercial and residential areas, respectively.

Under Group B are towns like Gelephu, Trashigang, Mongar, Trongsa, Paro and Samtse, where land taxes per.sq.ft are 40 and 20 chetrums for commercial and residential areas, respectively.

Zhemgang, Jakar, Tsimakothi, Damphu, Wangduephodrang, Punakha, Pemagatshel, Gomtu and Deothang are categorized as Group C. Land taxes in these towns are only chetrums 30 and 15 for commercial and residential areas. The last group comprises towns like Lhuntse, Chengmari, Kanglung, Daipham, Bangtar, Dagapela and Lamidara; where people pay only Chetrums 20 and 10 respectively per sq.ft.

“We do not find it logical to grade Samdrup Jongkhar town today with towns like Thimphu and Phuentsholing.

Further, Paro cannot be considered a Group B town now. And the taxes are ridiculous. Everything has changed and we hope that the government has also taken this into consideration in drafting the Property Tax Bill 2022,” Pema Tshering, a retired civil servant residing in Thimphu said if the government does not increase the taxes, issues like the sustainable development fee (SDF) increase in tourism will surface. “Due to the sudden increase from USD 65 to USD 200, people think the increase is huge and most will not understand conceptions like inflation. So, our legislatures should have the vision to go on increasing taxes etc lightly but regularly as people will not feel the pinch now, he said, adding that he and others are watching how “our elected leaders of the two houses will respond.”

While house rents in urban areas continue to increase, a building owner in Thimphu with a building with ten units, pays just Nu 1,000 as building tax in a year. And even if the lowest margin of Nu 10,000 per month is taken as house rent, the owner earns Nu 100,000 a month, which is Nu 1,200,000 per year.

Moreover, land tax per square foot in Thimphu is just 50 chetrum for commercial areas and 25 chetrum for residential areas, while current land prices in the capital have crossed Nu 1,200,000 and more for a decimal (435.6 sq.ft). “It is like a tax holiday that has been given to the rich. The people also should think over and realize that they ought to give some to the government,” Leki, a corporate employee said. “The discussions on this will show if our leaders really think about the nation or just their self-interests,” he added.

Further, due to the former classifications of different towns, people are also facing challenges in availing loans from financial institutions (FIs). “Though FIs understand that land value has increased in some districts and that these regions are no longer like what they used to be in 1992, there are still bureaucratic red-tapes due to the former classifications,” Sangay, a building owner from Gelephu said.

The other benefits of the new Bill would be on local governments and Thromdes. The Local Government Act 2009, Article 57, says: Gewog Tshogdes shall, at such rates as may be approved by Parliament, levy following taxes: Land tax, Building tax and other taxes. Similarly, the Act says that Thromde Tshogde may levy the following in a manner and at such rates as may be approved by Parliament: land tax; property tax and others.

“Thus, the responsibility falls on the parliament and it is disappointing to see that earlier governments were either unaware or turned a blind eye to this very important issue. It is encouraging to know that there will be changes,” a local government (LG) official said.

Further, the Bill would prevent people from asking for Property tax deductions or exemptions. “People from Bumthang and Haa recently requested the LG of the areas for such exemptions. An Act will leave no room for all this,” another LG official said.

In 2021, the Finance Ministry said the government is working on introducing the Property Tax Act, which will include a value-based taxation policy. It was reported that the new Property Tax Act will resolve ambiguities and biases that come from the Revised Taxation Policy 1992.

Many experts also cited the policy as the bottleneck as local governments including Thromdes cannot often carry out developmental activities required by urban policies due to lack of funds. “In the rural area, the gewog office collects the taxes and in Dzongkhag, the Dzongkhag administration collects that. When officials go to each household to collect tax, the revenue we generate isn’t even enough to pay our officials,” the Finance Minister had said.

The Asian Development Bank’s (ADB) Asian Development Outlook 2022, Mobilizing taxes for development, provides a complete picture of the economic scenario in Asia, challenges faced and the future of Asia’s economy. An important component of the report is about taxes and as pointed out in the title of the document itself, the report has illustrated how taxes can be mobilized for development. While most of what is mentioned is relevant for Bhutan, one of the most significant ones is Property Tax, which in Bhutan has remained unaltered and taxes on property collected as per the Revised Taxation Policy 1992. “More revenue can be raised as well from property taxes,” ADB’s report says, and a study of Property Tax in Bhutan shows how much the state has been losing, while property owners continue to benefit.

As per the agenda of the winter session, the motion for the first and second reading of the Property Tax Bill 2022 will be held on November 7, 2022.

Ugyen Tenzin from Thimphu