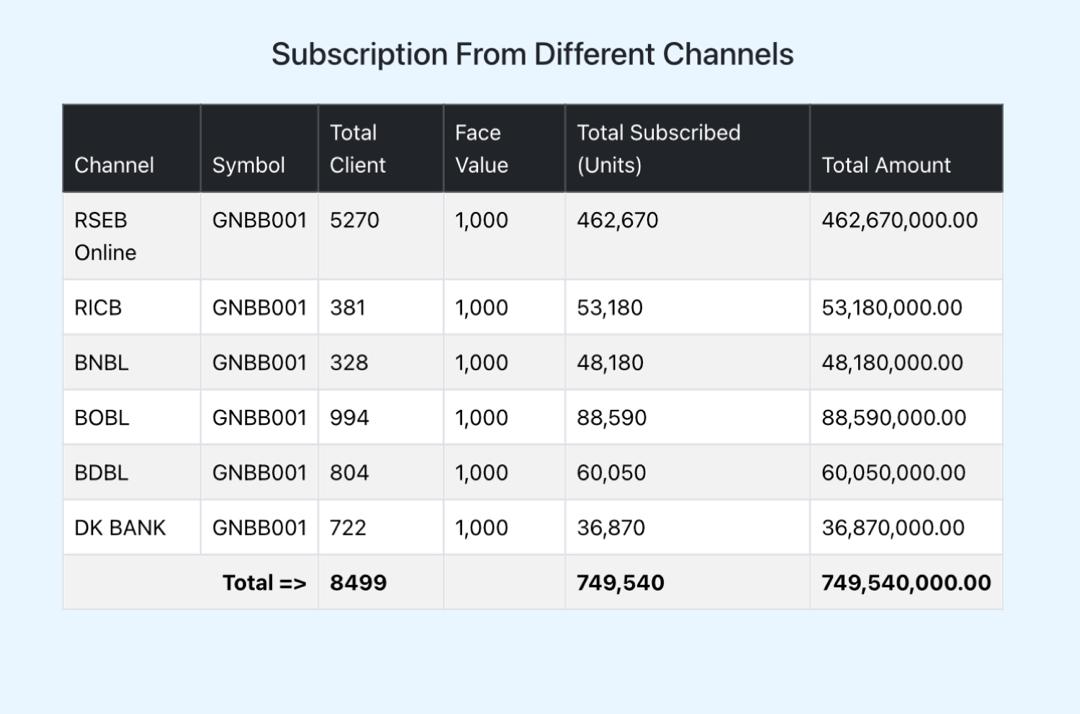

Since the launch of the Gelephu Mindfulness City Nation Building Bond (GNBB), by the Gelephu Investment and Development Corporation (GIDC), there has been a surge of interest among individuals to secure funding through various means to purchase these bonds. As of 1700 hours, Bhutan Standard Time (BST), May 23, 2025, a total of Nu 749,540,000.00 was secured through the sale of the bonds. However, there are also people who dearly desire to secure the bonds but cannot do so, due to financial constraints.

Among the many enthusiastic investors is a senior Member of Parliament (MP), who has been actively approaching financial institutions in an effort to obtain a loan to finance his investment.

“It’s not just me applying for the loan, my wife is also trying,” he shared. He emphasized the strong motivation behind their efforts, citing the dual benefits of the investment. “The bonds not only promise attractive returns but also allow us to contribute meaningfully to a national initiative. That makes it all the more important for me to secure them,” he added.

Tshering Dorji, a self-employed resident of Thimphu, is another enthusiastic investor who has already secured bonds from the Gelephu Mindfulness City (GMC) initiative. Tshering shared that he spent the first two weeks exploring alternative sources of funding in the hopes of purchasing the bonds, but his efforts proved unsuccessful. Ultimately, he turned to what he described as his “last resort.”

“I had to break my fixed deposit account with a local bank,” Tshering revealed. Although his fixed deposit was just two years away from maturity, he made the difficult decision to liquidate it. The reason, he explained, was that the anticipated returns from the GMC bonds are expected to exceed what the bank would have offered through his deposit.

“More importantly,” he added, “this investment is about more than just financial gains. Contributing to the development of Gelephu feels like a meaningful way to give back to the country. It’s an opportunity to be part of something much larger than myself.”

A civil servant, who wished to remain anonymous, shared that she is eagerly waiting for her monthly salary in order to invest in the Gelephu Mindfulness City (GMC) bonds. While acknowledging that her salary alone may not be a substantial amount, she revealed that she has taken an additional step to make the investment possible—by borrowing funds from a relative currently residing in Australia.

“I’ve borrowed Nu. 200,000 from a family member, and along with my upcoming salary, I plan to purchase the bonds,” she explained. According to her, securing the loan from her relative was relatively easy due to a unique agreement between them.

“The condition is straightforward: if I fail to repay the loan within the agreed timeframe, I will forfeit ownership of the bonds to my relative. Because of that assurance, they had no hesitation in lending me the money,” she said.

For her, too, the decision to invest in the GMC bonds represents not only a financial opportunity but also a personal commitment to supporting a project of national significance.

Goembo Dorji, a 67-year-old resident of Thimphu, has also chosen to part with his long-held savings to invest in the Gelephu Mindfulness City (GMC) bonds. However, Goembo’s story stands out from the rest—his decision was not for personal financial gain, but a heartfelt gesture toward the next generation. His decision reflects a deeper philosophy, one that blends personal legacy, familial responsibility, and national contribution.

Instead of purchasing the bonds for himself, Goembo chose to divide his savings equally among his four grandchildren, enabling each of them to invest in the bonds. “At first, I intended to buy the bonds for myself, thinking it would be a wise investment for the future,” he shared. “But then I reflected on impermanence, my advancing age, and realized that it would be far more meaningful to pass on what I have to my grandchildren.”

For Goembo, the value of this act extends beyond monetary returns. “In addition to supporting a national initiative and securing financial gains, I’ve had the rare opportunity to give something tangible and significant to my grandchildren—something that symbolizes both love and foresight,” he said.

While many individuals have successfully purchased the bonds, aligning themselves with what is seen as a noble national cause, there are others who, despite having a strong desire to participate, are simply unable to do so due to financial constraints.

One such individual is Sonam Dorji, an employee of a private company based in Phuentsholing. Expressing his disappointment, Sonam said, “For people like me, it’s just not possible to afford the bonds. We understand their significance and truly wish we could be a part of this important national initiative. But financially, it’s out of reach.”

Sonam believes that if financial institutions had introduced a dedicated loan scheme specifically for bond purchases, it could have opened the door for many more to participate. “If banks had offered financing options, they would not only have benefited themselves through interest returns, but they also would have empowered a broader section of the population to invest in the bonds,” he said.

He added that his sentiment highlights a broader challenge: while the bonds are viewed as a meaningful and rewarding investment, access remains limited for those without disposable income or collateral.

Ugyen Tenzin from Thimphu